how long does coverage normally remain on a limited-pay life policy

The short answer to How Long Does the Coverage normally remain on a limited pay life policy is usually until age 100 or until death. For example a 500k 10 year limited pay whole life insurance policy will cost more than a 500k 20 year policy.

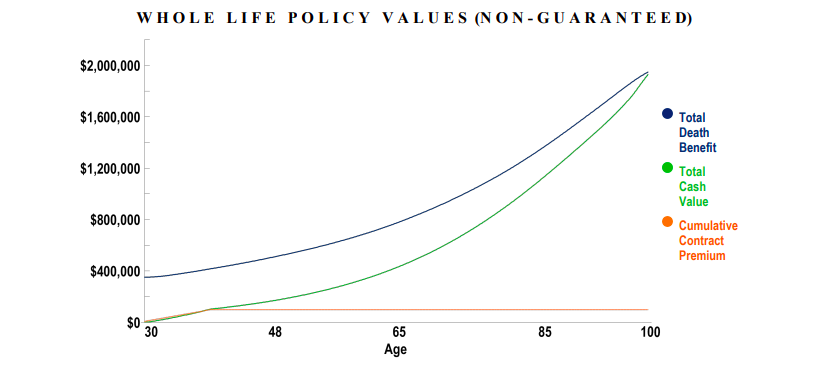

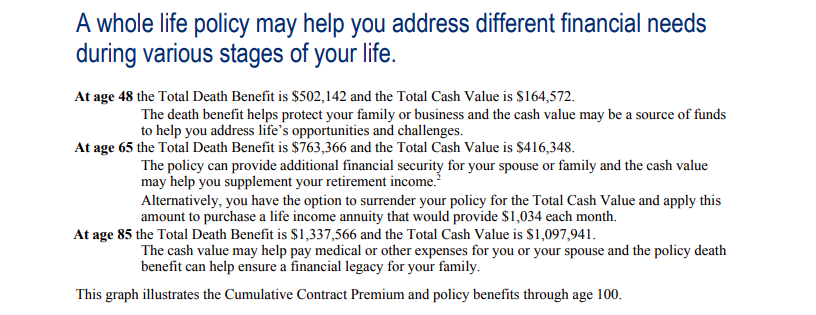

Limited Pay Whole Life Insurance What Is It See The Numbers

How long does the coverage last on a limited pay life policy.

. Premiums are payable for 10 15 or 20 years depending on the policy selected. MCQs Papers Definitions Flashcards. Paid Until Age 65.

Ad Get Instantly Matched with Your Ideal Life Insurance Plan. What is an example of a limited pay life policy. Premiums are payable for 10 15 or 20 years depending on the policy selected.

The short answer to How Long Does the Coverage normally remain on a limited pay life policy is usually until age 100 or until death. When a whole life policy matures the full death benefit minus loans and past due premiums is paid to the still living insured. Usually the rates of limited pay whole life policies are paid during a 10 to 20 year period.

The short answer to How Long Does the Coverage normally remain on a limited pay life policy is usually until age 100 or until death. On new policies maturity is age 121. Premiums on limited payment life insurance are paid for a limited number of years but the benefits last a lifetime.

At the beginning of the sixth year the premium will increase to 800 per year but will remain level thereafter. The quick answer to the question How Long Does Coverage Normally Remain on a Limited Pay Life Policy is usually until age 100 or until death. Why do limited pay policies.

The face amount will remain at. Limited Payment Life Insurance a life insurance policy that covers the insureds entire life with premium payments required only for a specified period of years. Traditional permanent life insurance premiums are paid for the whole duration of an individuals life.

The shorter the pay period the more expensive your premiums will be. How long does the coverage normally remain on a limited-pay life policy. That being said certain life insurance providers put limits on the length of coverage for limited pay life insurance policies.

How Much will the insurance company pay the benficary 20000 death benefit a. Premiums are typically paid over the first 10 to 20 years. This type of life insurance covers you for as long as you live even after the premium payment period is complete.

Another component of limited-pay policies is that they offer monthly quarterly or yearly payments. Age 65 age 100 when premium payments stop at the discretion of the insurer. Which of these would be considered limited pay life policy life paid up at age 70 k pays 20000 20 year endowment policy for 10 years and dies in an accident.

What is an example of a limited pay life insurance policy. You can pay premiums monthly quarterly semi-annually or annually. As a general rule of thumb fewer years results in a higher annual premium.

Premiums on limited payment life insurance are paid for a limited number of years but the benefits last a lifetime. Limited PAY Whole Life means you pay it for 1020 years and the payment stops but the coverage lasts to maturity. Now Offering New Rates for Smokers and Non-smokers.

Another feature that sets a limited pay life insurance policy apart from the competition is that there is great flexibility when it comes to paying your limited pay life policy life insurance rates. The short answer to How Long Does the Coverage normally remain on a limited pay life policy is usually until age 100 or until. What is the main difference between whole life insurance and limited pay life insurance.

Ad Protect What Matters Most with Term Life Insurance from New York Life. When choosing the limited pay whole life option the payment length must be determined at the initial purchase of the policy. How Long Does the Coverage Last on a Limited Pay Life Policy.

Age 100 What kind of life policy either pays the face value upon the death. 455 73 votes. She pays 600 per year in premium for the first 5 years.

You can choose to pay for your policy. However the quicker you pay up your policy the faster you optimize growth in your cash value and dividends. Limited Pay Life policies such as LP65 and 20-Pay Life.

Decreasing Term life policy At what point does a whole life policy endow. This is the main reason that term insurance is far less expensive than whole and universal life insurance. Incremental limited pay life insurance policies between 10 and 30 years can be customized depending on when you want to stop paying into your policy.

When selecting the limited pay whole life option the payment length must be selected at the time of policy acquisition. On older policies that could be as low as age 95. The most common options include.

Age 100 What type of life policy has a death benefit that adjusts periodically and is written for a specific period of time. You can pay premiums monthly quarterly semi-annually or annually. Under a Graded Premium Whole Life policy the premium increases each year during the early years of the contract and remains the same after that time J is insured a Life Insurance policy with a death benefit of 100000.

Browse Your Options Now. For example limited pay life insurance contracts may provide coverage up until the age of 100 oras is becoming more common120 years. M purchases a 70000 Life Insurance Policy with premium payments of 550 a year for the first 5 years.

Life policy offers the owner investment in products such as money market funs long term bond and equities. With the plans listed above the annual costs are. Lets start by looking at the different payment terms.

This policy guarantees the benefit forever and yet only has payments for 15 years. This policy guarantees the benefit forever and yet only has payments for 15 years. The Most Reliable Life Insurance Companies That Will Actually Cover Your Loved Ones.

The coverage period for limited pay life policies is often a source of confusion. Guaranteed cash value grows tax-deferred. Age 100 All of these statements about Equity Indexed Life insurance are correct EXCEPT The premiums can be lowered or raised based on investment performance Term insurance has which of the following characteristics.

How long does the coverage normally remain on a limited-pay life policy. Get a Quote Today. How long does coverage remain on a limited pay life policy.

When the cash value equals the death benefit. How long does the coverage normally remain on a limited-pay life policy. You may pay for your premiums monthly quarterly semi-annually or annually if you select to do so in a restricted time periodtypically 10 15 or 20 years.

If you pay the entire year up front you can usually save some money while maintaining coverage and the same cash value. How long does the coverage normally remain on a limited pay life policy. How long does the coverage normally remain on a limited-pay life policy.

Expires at the end of the policy period. How long does the coverage normally remain on a limited-pay life policy.

Universal Life Insurance Good Investment Strategy Policyme

What Is Whole Life Insurance And How Does It Work Lincoln Heritage

What Is Whole Life Insurance And How Does It Work Lincoln Heritage

Whole Life Insurance What It Is And How It Works 2022

.jpg)

Universal Life Insurance Good Investment Strategy Policyme

How Long Can You Stay On Long Term Disability Ltd Cck Law

2022 Final Expense Insurance Guide Costs For Seniors

Guaranteed Issue Life Insurance Policies Fidelity Life

Northwestern Mutual Life Insurance Review Best For Smokers Valuepenguin

Limited Pay Whole Life Insurance What Is It See The Numbers

Health Insurance And Pregnancy 101 Ehealth Insurance

Limited Pay Whole Life Insurance Comprehensive Guide To The Best Policies With Sample Rates

Limited Pay Whole Life Insurance Comprehensive Guide To The Best Policies With Sample Rates

How Hybrid Life Insurance Pays For Long Term Care Forbes Advisor

Limited Pay Whole Life Insurance What Is It See The Numbers

Guaranteed Issue Life Insurance Policies Fidelity Life

Guaranteed Issue Life Insurance Policies Fidelity Life

Limited Pay Whole Life Insurance Comprehensive Guide To The Best Policies With Sample Rates